Built for CFOs- Open Banking Powered Tech Stack

"Built for CFOs" series talks about innovations and products that are changing the way in which- Finance teams operate, CFOs make decisions and Businesses optimise their operations.

Hello, everyone, and thank you for reading. I love building tech products and strategies. My last 12+ years have been in the technology space as—an engineer, a Big 4 Management consultant, founding member of an Indian fintech, and now a builder in the European startup space. This blog is a way for me to share my learnings and observations.

This is my second post in the “Built for CFO” series. It discusses how open banking has fueled innovation and added solutions to finance teams' tech stacks. These solutions help finance teams with Accounting, Reconciliation, Treasury Management, Spend Management, strategic decision-making, etc. So read on, and please comment or DM me with your thoughts.

Recap- Part 1 of my “Built for CFOs” series can be found here.

Open banking has transformed the fintech space by providing access to extensive financial data through APIs, fostering innovation and increasing competition. Let us dissect this in more detail!

(1) What is Open Banking?

Open Banking lets you securely share your banking information, like transaction history and account details, with third-party apps and services through APIs (Application Programming Interfaces). Consumers can also transfer funds and initiate payments via these APIs.

Open banking aims to increase competition and innovation in the financial services sector by giving consumers more control over their financial data and enabling them to access a broader range of financial services.

For instance, Finance teams can link all bank accounts to a Treasury app to get centralised view of money movement and advice to optimise cash position.

Size

A 2023 report by Juniper Research predicts that open banking payment transaction values will exceed US$330 billion globally by 2027.

Open Banking outside of Europe:

The term "open banking" is more formally associated with regions where specific regulatory frameworks (like PSD2 in Europe) mandate and standardize data sharing through APIs. Depending on the region, these companies may adhere to local open banking standards or use similar approaches to achieve their goals.

Risks associated with open banking:

Open banking offers innovation and consumer control but introduces risks like data privacy concerns, fraud, and regulatory compliance challenges.

The complexity of third-party involvement can lead to operational and security vulnerabilities, requiring strong safeguards.

Mitigating these risks involves robust security measures, clear legal frameworks, and consumer education.

Proper management of the above ensures the benefits outweigh the risks.

(2) How CFOs and finance teams benefit from Open Banking?

CFOs now have access to products powered by open banking that offer real-time financial data, enabling more accurate cash flow management, improved financial visibility, and improved liquidity. They also have access to tools that streamline reconciliation, accounting, and payment processes, reducing manual effort and operational costs. These products remove the operational overhead of working off Excel sheets and disparate systems.

With these products, CFOs and finance teams can focus on what matters—making data-driven decisions, optimizing cash position, managing risk, and ensuring compliance with financial regulations.

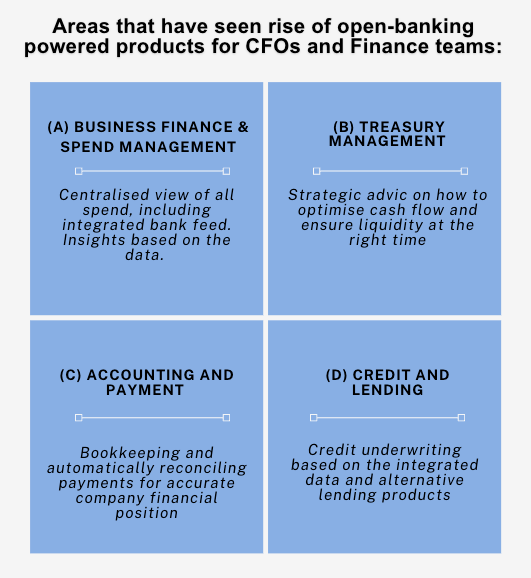

Overall, open banking-powered products empower CFOs to manage company finances more efficiently and strategically. Here are some of the areas that have seen the rise of products for CFOs and finance teams:

Some of the players are:

The above platforms access and aggregate real-time financial data from various banks via APIs. This gives users of the platforms- CFOs, Finance teams, and even general consumers, real-time access to the financial data and strategic advice around spending, saving, risk management, cash flow optimisation etc.

Some other use cases include accounting & reconciliation, improved access to credit and alternative lending.

Case studies from each category

(1) Treasury Management

These startups are increasingly leveraging open banking to provide CFOs with enhanced tools and insights that improve liquidity management, cash flow forecasting, and overall financial decision-making.

Trovata consolidates information from multiple banking partnerships into a single platform via APIs, giving treasury teams a comprehensive, real-time view of their company’s liquidity.

(2) Spend and Expense management

Spend and expense management startups leverage open banking to provide CFOs with real-time visibility into company spending by directly integrating with bank accounts. This allows for automatic tracking and categorization of expenses, reducing manual data entry and minimizing errors. CFOs benefit from real-time insights into cash outflows, enabling more accurate budgeting and cost control by setting up workflows.

Expensify allows businesses to connect their other bank accounts via Plaid and build workflows.

(3) Accounting and payments

Accounting and reconciliation startups utilize open banking to provide CFOs with automated, real-time access to financial data from various bank accounts. This integration streamlines the reconciliation process by automatically matching transactions with accounting records, significantly reducing manual work and errors.

Sage allows you to connect to all major banks to automatically import transactions, create payments, automate direct debit and more..

(4) Credit underwriting and lending

Credit underwriting startups leverage open banking to give CFOs a more comprehensive view of a customer's or partner's creditworthiness by accessing real-time financial data directly from bank accounts. This allows for more accurate and data-driven credit risk assessments, reducing reliance on traditional credit scores alone.

Bud’s AI-powered platform uses data from open banking for its AI-powered algorithm. One of the use cases they have built for is lending. Companies like Zopa, Moneyboat, JAJA, etc use Bud’s platform.

Why are the above Fintechs using open banking to build products for CFO tech stack?

Executive summary

PSD2 (and equivalent standards) have successfully achieved what they aimed for—easy data sharing and financial transparency. This, coupled with technologies like AI and Automation, has given rise to a plethora of solutions for the CFO and finance tech stack, but I feel the best is yet to come. More and more startups are building for finance persona (and raising funding). Established players and ERPs are also adding more offerings to their product suite. As someone who is part of this ecosystem, I am rooting for the players and hoping to contribute in whatever way possible.

Of course, this comes with the challenge of how finance teams will identify the right products for their context and run effective change management to encourage employees to use latest technologies. Strong leadership can help show direction and steer the way for this change.

Next, in the “Built for CFOs” series- AI and Automations for finance teams.